Klarna is one of the most popular apps for online consumers who want to buy something but don’t want to pay the total amount right away. However, it would be best to look at Klarna alternatives to expand your options and ensure you’re receiving the best value. That said, what are some of the best Klarna alternatives?

- Affirm: Buy Now Pay Overtime

- PayPal Credit: Send, Shop, Manage

- Afterpay: Interest-free Payments

- Sezzle: Buy Now, Pay Later

- Zip: Pay later in four

- Fingerhut: Mobile Payment

- Four: Buy Now and Pay Later App

- Perpay: Pay Later

- Laybuy: Shop Now Pay Later

Apps that allow you to buy now and pay later are really beneficial, especially if you’re short on funds for the month. The best part is that, unlike credit cards, most of the purchases now, pay later apps on this list do not charge interest. So, let’s take a closer look into what these apps have to offer you.

The Best Apps Similar to Klarna

Among e-commerce platforms and online buying apps, Klarna is well-known. Although several e-commerce and online purchasing platforms exist, few offer perfect payment choices; therefore, flexible payment installments have grown in popularity over time.

People throughout the world adored the concept of paying cash in installments. Klarna is an example of an app that has made a reputation among purchase now pay later apps and online shopping and e-commerce platforms.

The app does everything it can to help users who wish to make online payments for online stores and pay directly. However, different names have become available in the market with apps like Klarna that can replace Klarna.

With some exclusive features, users can go for Klarna’s alternatives that have some initiative features, best offers, deals, and different installments offers. Here’s what they bring to your wallet, starting with Affirm.

1. Affirm: Buy Now Pay Overtime

App rating:

Google Play – 4.7 of 5 stars

App Store – 4.9 of 5 stars

First on the list is Affirm. Affirm, like Klarna, has no late fees, service fees, or prepayment penalties. However, depending on the type of plan you have, Klarna may incur additional costs. Affirm doesn’t charge any fees.

Affirm is without a doubt one of the most convenient “buy now, pay later” apps. The reason for this is simple: unlike many credit-based programs, Affirm does not impose penalties if you pay off your loan late. As a result, if you’re ever late on a payment, you won’t have to worry about paying more than the amount you borrowed.

Affirm is fantastic when it comes to interest because its fees on specific transactions are straightforward. As a result, you don’t have to be concerned about interest compounding exponentially. The disadvantage is that unlike other purchases now, pay later applications; Affirm does charge interest.

Depending on the store, this can range from 0% to 10% or even 30%. As a result, it’s not ideal if you’re looking for an app that doesn’t charge any interest.

Nonetheless, if you want flexible, long-term payment plans, Affirm is a terrific option. Because the app allows you to pay in three to 36 months, this is the case. Furthermore, due to its $17,500 transaction maximum, it’s one of the best BNPL (buy now, pay later) apps if you need to make massive purchases.

Because Affirm is so widely used, you may use it to purchase at various online and physical retailers. You can generate a virtual card number instead if a store isn’t affiliated with Affirm. The app also has no minimum credit history requirement, so you’ll have no difficulty being authorized.

Affirm Features

- There are no late fees.

- Payments can be made at any time.

- The maximum limit is quite high.

- Purchases can be made either online or in person.

2. PayPal Credit: Send, Shop, Manage

App rating:

Google Play – 4.3 of 5 stars

App Store – 4.8 of 5 stars

Paypal Credit has established itself as one of the most popular platforms for making and receiving payments. It is one of the platforms that has grown in popularity as a result of its widespread use. Paypal is one of the newest venues to provide revolving credit cards.

In exchange, consumers get access to a reloadable credit line linked to their PayPal accounts. These credits may then be used to make online purchases and pay them off in installments. Paypal is an excellent alternative to Klarna and is also the best option for PayPal users.

However, consider that the installment interest rate is higher than some of the other applications on the list. However, no interest will be charged on purchases of $99 or more, but only if the entire amount is paid in full during the six months from purchase. This app is available on either the Android or iOS operating systems.

PayPal Credit Features

- It shows up right away.

- There are no predefined installment times, only a deadline.

- Accepted anywhere PayPal is accepted.

- Setup is quick and simple.

- The credit is interest-free for the first four months.

3. Afterpay: Interest-free Payments

App rating:

Google Play – 4.6 of 5 stars

App Store – 4.9 of 5 stars

When it comes to the best Klarna alternatives apps, I couldn’t leave Afterpay out. Afterpay is a firm established in Australia recently bought for $29 billion by Square, a digital payment startup co-founded by Twitter CEO Jack Dorsey.

Because Afterpay does not collect interest on its loans, it is not considered a POS loan provider; yet, it is generally referred to as a BNPL provider; therefore, I’ve included them in our round-up.

People who can make on-time payments, require a short-term financing alternative with 0% interest, and don’t want the loan to harm their credit score can use Afterpay. The business only has one product: a six-week financing option with four installment payments due every two weeks.

You pay a one-time deposit, usually 25% of the total order, and the remaining balance over six weeks. With Afterpay, there is no limit to how much credit you may take out. Your credit limit is determined by how long you’ve been an Afterpay user and if you’ve been paying on time and completing payments.

Because a new user’s limit is likely to be lower than someone with a long history, if this is your first time using Afterpay, you may need to stick to smaller-ticket products. Afterpay orders are typically around $150.

One of the most significant benefits of choosing Afterpay over other POS providers is that it has no impact on your credit score – the firm doesn’t monitor your credit score or submit any loan information to the credit agencies.

The late fees are a significant disadvantage of utilizing Afterpay. For each late payment, you’ll be charged an $8 fee or 25% of your transaction, whichever is smaller. If you don’t make a payment, you won’t be able to use the platform to apply for a new loan until you do.

When it comes to merchants, Afterpay is accepted at over 100,000 locations worldwide, including American Eagle, Bed Bath & Beyond, and lululemon. Some customers may also use the Afterpay app to make purchases at specific merchants, including Nike, Kroger, Amazon, and Macy’s.

You’ll be awarded a one-time virtual card every time you use the app. On the Better Business Bureau website, Afterpay, like the other POS suppliers in this round-up, has terrible customer service ratings.

Many consumer complaints were about the merchant canceling purchases or failing to secure a refund through Afterpay. Based on its own scoring system, the Better Business Bureau awards Afterpay an A-.

Afterpay Features

- There are no extra fees and no interest if you pay your bills on time.

- Every two weeks, you’ll get four interest-free installments.

- Check out your stuff right away.

- Innovative credit limits assist you in budgeting.

- It reminds you to pay your bills.

4. Sezzle: Buy Now, Pay Later

App rating:

Google Play – 4.7 of 5 stars

App Store – 4.9 of 5 stars

Sezzle is a similar app to Klarna that seeks to make purchasing more convenient for its users. It allows you to make direct, interest–free payments.

You must pay 25% of the total amount at the time of purchase, with the remainder paid out into four installments over six weeks. As long as you pay your bills on time, the app will not charge you any interest or processing costs.

It is straightforward to use and may be used both in-store and online. However, you should be aware that certain banks do not support Sezzle, so it is essential to verify with your bank before making installment payments.

Sezzle Features

- It has flexible payment arrangements.

- Payments can be rescheduled for up to two weeks.

- There is no interest in purchases.

- A single payment schedule (four payments in six weeks).

5. Zip: Pay later in four

App rating:

Google Play – 4.4 of 5 stars

App Store – 4.9 of 5 stars

The Zip app is another excellent Klarna substitute ( Zip is formerly Quadpay). You can acquire adequate financing with Zip without worrying about your credit history. It is because the app does not examine your credit score before approving your application.

Additionally, Zip does not record your activities to any credit bureau in the United States. As a result, you don’t have to be concerned about poor performance negatively impacting your credit score.

The main drawback of Zip is the number of fees it charges. It charges a $4 transaction fee for every purchase or a $1 transaction fee for each payment. In addition, the platform levies a $7 late fee for each late payment. When all of these factors are considered, the fees alone can rapidly add up to thousands of dollars.

Furthermore, if you’re searching for long-term finance, the app isn’t perfect. It only offers a six-week loan duration and nothing more. With 51,000 worldwide partner merchants and a convenient browser plugin, the app could make up for it. However, you must decide if the trade-offs are worthwhile.

Zip Features

- There is no curiosity at all.

- There will be no credit check.

- Credit bureaus are not notified.

- There are 51,000 traders in the world.

- Non-partner shops can use a browser plugin.

6. Fingerhut: Mobile Payment

App rating:

Google Play – 4.2 of 5 stars

App Store – 3.1 of 5 stars

Another great app like Klarna is Fingerhut. Fingerhut is one of the most remarkable BNPL apps for individuals who require credit but do not have a decent credit score. It doesn’t look at your credit history to get you accepted in the first place. As a result, even individuals with poor credit can apply and be approved.

The good news is that Fingerhut is an excellent location to start improving your credit ratings. Your account with all three main credit bureaus displays your good payment habits on the app. It also has no yearly fees that might add to the cost of your payment.

However, Fingerhut comes with a slew of drawbacks that you’ll have to live with to improve your credit score. For starters, you can use only their website to buy from or one of their partner stores.

Furthermore, their website’s pricing is excessive, with a 29.99 percent Annual Percentage Rate. A $38 fee is also charged for returned or late payments. Nonetheless, if you’ve been turned down everywhere else and need credit regardless of your credit score, it’s a good option.

Fingerhut Features

- There are no credit history reviews.

- There is no yearly charge.

- Timely payments increase your credit score.

- Payments can be split into 6 or 8 installments.

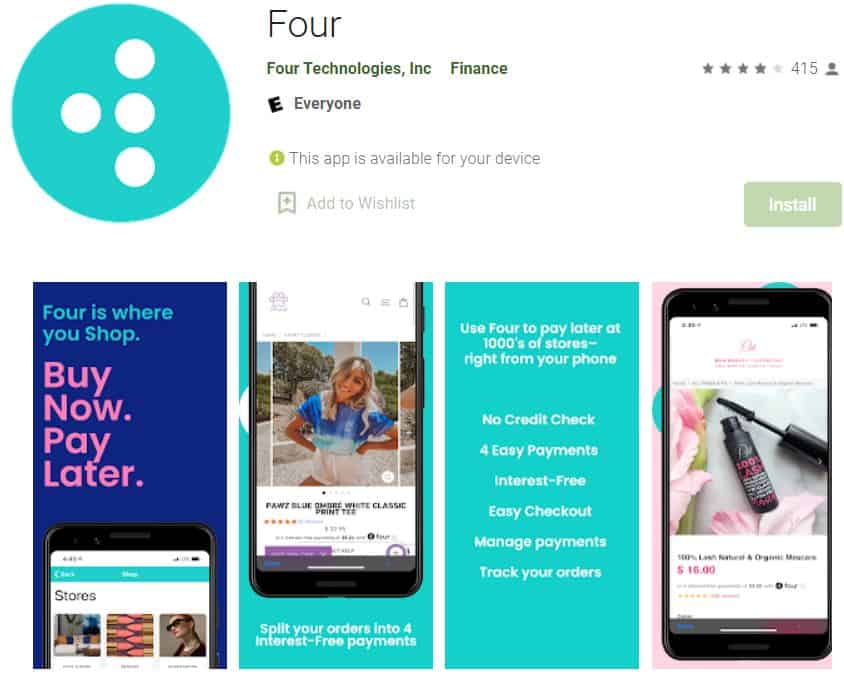

7. Four: Buy Now And Pay Later App

App rating:

Google Play – 2.5 of 5 stars

App Store – 4.0 of 5 stars

Four is an excellent Klarna alternative. Four is a one-stop shop for anybody searching for conversions, sales, or a robust platform for retailers.

And because the primary goal of Four is to give a payment option that allows a buyer to pay in four installments, you can imagine why the developers chose the term Four for their software.

It’s one of the better apps, similar to Klarna, that charges no interest on these four installments. Keep in mind that your credit score might have an impact on your purchasing experience, so make sure it’s excellent. When discussing apps like Klarna, there is a name that must be mentioned.

It offers a relatively upfront and straightforward checkout method that guarantees no issues or barriers regarding credit checks and form filling. To put it another way, consumers may readily utilize the app because there are no complicated procedures.

Four’s Features

- The setup and approval procedure are simple.

- The user interface is intuitive and straightforward to use.

- Financing solutions that do not require an interest rate.

- There is no impact on your credit score.

- It is divided into four equal payments.

8. Perpay: Pay Later

App rating:

Google Play – 4.0 of 5 stars

App Store – 4.7 of 5 stars

Perpay has made its name known by claiming to be one of the platforms with accessible payment gateways. Shoppers will be given a series of questions after signing up with Perpay, determining their spending limit.

These spending limitations often vary from $500 to $2500, which, in my opinion, is more than enough for any buyer. After you’ve finished answering these questions, you’re free to go crazy and check out things from a variety of stores.

Perpay operates on the principle of paying one installment at the time of purchase, which is subtracted from the total payments. Furthermore, the program tends to deduct installments from paychecks automatically, so there’s no need to worry about missing the due date.

Users must be frequent and devoted Perpay users to increase their limit; thus, the app’s users determine the spending limitations. Without a doubt, Perpay is a must-have app for every app collection. This payment gateway app is available for Android and iOS users as one of the top apps like Klarna.

Perpay Features

- There will be no credit check.

- Limit dependent on income.

- A 6-month finance term is available.

- Increases credit score by making on-time payments.

9. Laybuy: Shop Now Pay Later

App rating:

Google Play – 4.6 of 5 stars

App Store – 4.6 of 5 stars

On to the next Klarna alternative, Laybuy, which has earned the trust of its faithful consumers owing to its dependability. The software contains merchandise from both in-store and online stores, benefiting them both.

Laybuy is a similar software to Klarna that is dependable for consumers who want to shop and pay in installments. You can use the app both online and in stores, which means you won’t have to worry about missing your cash or credit card.

When you utilize Laybuy, the total cost of the item is divided into six installments over five weeks. The first 1/6 of the total cost will be charged at the time of purchase.

The disadvantage is that you may be subjected to a credit card check throughout the application process, which may negatively impact your total credit score. Fashionistas will like this platform since many of the company’s merchants are from the fashion and entertainment industries.

But, before you start fantasizing, keep in mind that this platform is only available to New Zealand purchasers, and the app will only take cards issued by New Zealand banks. However, it’s based on the “layby” concept, in which buyers reserve an item at a store, pay for it in installments, and then pick it up after it’s paid for.

Layby is popular in New Zealand and Australia, and it was once known as “layaway” in the United Kingdom.

Laybuy Features

- Zero-interest and Payments are made in six-week increments.

- There are no registration costs.

- The online and in-store merchants are simple to use and intuitive.

What are Buy Now, Pay Later (BNPL) Apps?

We now have a plethora of apps that can perform practically anything for us, including financial management. Dave and other money transfer or cash advance apps help boost our funds and relieve some of our financial stress. Similarly, BNPL apps can help people who are short on funds.

Apps that allow you to buy now and pay later do precisely that. They’re apps that let you buy things right now without having to pay for them in advance, as with a credit card. Later on, you can pay them in installments over a defined time, typically four payments.

They are appealing because, unlike credit cards, they usually do not charge interest. Their approval processes are also less stringent, making it easier to apply for them. Of course, fines still apply if you pay late or don’t pay as all, so you’ll have to be cautious.

Loan and cash advance apps are not the same as buy now, pay later apps. The latter usually necessitates depositing earned income into a checking account before receiving your paycheck.

They’re apps that send you to cash in advance of your next payday, as the name indicates. Buy now, pay later apps, on the other hand, allow you to spend money you don’t have. You’ll have to handle the financing and payments yourself subsequently, without the app interfering with your pay.

Cash advance apps may in helpful in a pinch, especially if your preferred merchant doesn’t have a buy now, pay later app. However, each has its own advantages and disadvantages and will be helpful in different situations.

Conclusion

These apps are the most fantastic Klarna substitutes, and they may assist you by making small monthly payments. Just be careful not to be caught in a debt trap, especially if you’re utilizing shopping apps that might negatively impact your credit score.

It might take some time to locate the ideal “buy now, pay later” app. When using these apps, however, proceed with caution. To prevent having too many loans, I propose that you test them out one at a time.

Remember to be an educated and responsible shopper while dealing with e-commerce and online transactions to prevent fines or additional charges.

References:

Forbes: Buy Now Pay Later New Payment Trends

Cellular News: 10 Best Apps Like Klarna to Split Your Payment for Shopping

Credit Karma: Apps Like Klarna